Prepare for higher dividend tax

To balance the increase in NIC payable on salaries and self-employed profits, the tax you pay on dividends will also increase by 1.25 percentage points from 6 April 2022.

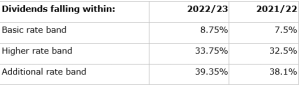

The dividend allowance has been frozen at £2,000; you pay zero tax on dividends which fall within that allowance. Any additional dividends are charged to tax at a rate dependent on which tax band they fall into (see table).

If you have surplus cash held within your own company, you may wish to consider paying out a higher dividend to the shareholders before 6 April 2022, rather than later. Where different shareholders in your company hold slightly different classes of shares the dividends paid out can be tailored to the shareholder’s needs.

The company needs to have sufficient retained profits to extract as dividends and you should first check that the cash is not needed for other purposes, such as paying tax bills or investment in plant.

We can calculate how much you can extract from your company as dividends in 2021/22, to beat the dividend tax rise that applies from 6 April 2022. However, it’s also important that bringing forward dividends into 2021/22 won’t push the recipients into higher tax bands.