EMPLOYERS FACING DECREASED DEMAND (JSS OPEN)

For businesses facing reduced demand the JSS Open scheme will give employers the option of keeping their employees in a job on shorter hours rather than making them redundant. The government has announced that it will increase the scale of support available to employers through JSS Open above what was initially announced, in order to protect more jobs.

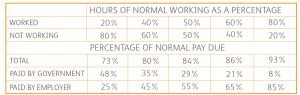

The employee will need to work a minimum of 20% of their usual hours and the employer will continue to pay them as normal for the hours worked. Alongside this, the employee will receive 66.67% of their normal pay for the hours not worked – this will be made up of contributions from the employer and from the government. The employer will pay 5% of reference salary for the hours not worked, up to a maximum of £125 per month, with the discretion to pay more than this if they wish. The government will pay the remainder of 61.67%, of reference salary for the hours not worked, up to a maximum of £1,541.75 per month. This will ensure employees continue to receive at least 73% of their normal wages, where they earn £3,125 a month or less.

Employers are eligible to claim the JSS Open if:

- an employer with 250 or more employees on 23 September 2020 has undertaken a Financial Impact Test demonstrating their turnover has remained equal or fallen to show they have been adversely affected due to coronavirus; and

- an employer with less than 250 employees on 23 September 2020 is not required to satisfy the test

- some, or all, of their employees are working reduced hours – employees must still be working for at least 20% of their usual hours

The financial impact test for large employers means reviewing turnover and if it has remained equal or has decreased compared to the previous year, then they will qualify. This test only needs to be taken once before the employers first claim for the Job Support Scheme. The test will be done by comparing quarterly VAT returns for the period between 31 August 2020 and 7 November 2020, with the total sales figure from the same quarter in 2019. For those preparing monthly returns should compare the three consecutive months which are due to be filed and paid by 7 November 2020 with the same period in 2019.

Employers who file less frequently should compare the three consecutive months which are due to be filed and paid by 7 November 2020 with the same period in 2019 but will need to have submitted a VAT return between 31 August 2020 and 7 November 2020 to be eligible.

Large employers who are part of a VAT group will use the turnover figures for the VAT group for this calculation.

Any charity with 250 or more employees that is registered with a UK charity regulator or are exempt from such registration will not be required to carry out the test and are eligible for this scheme.

The table below shows the level of cost to the employer at different levels of work performed by employees:

EMPLOYERS WHO ARE LEGALLY REQUIRED TO CLOSE THEIR PREMISES (JSS CLOSED)

Employers who have been legally required to close their premises as a direct result of coronavirus restrictions set by one or more of the four governments of the UK are eligible for JSS Closed.

This includes premises restricted to delivery or collection only services from their premises and those restricted to provision of food and/or drink outdoors.

Businesses premises required to close by local public health authorities as a result of specific workplace outbreaks are not eligible for this scheme.

Employers are only eligible to claim for periods during which the relevant coronavirus restrictions are in place. Employers will not be able to claim JSS Closed to cover periods after restrictions have lifted and the business premises are legally allowed to reopen. They may then be able to claim JSS Open if they are eligible.

Each employee who cannot work due to these restrictions will receive two thirds of their normal pay, paid by their employer and fully funded by the government, to a maximum of £2,083.33 per month, although their employer has discretion to pay more than this if they wish.

Eligible employers will be able to claim the JSS Closed grant for employees:

- whose primary workplace is at the premises that have been legally required to close as a direct result of coronavirus restrictions set by one or more of the four governments of the UK

- that the employer has instructed to and who cease work for a minimum period of at least 7 consecutive calendar days

The policy statement outlines closed temporary working agreements and recommends employers should discuss with their staff and make any changes to their employment contract by written agreement. When employers are making decisions in relation to the process, including deciding who they should instruct to cease work, equality and discrimination laws will apply in the usual way.

To be eligible for the grant, employers must have reached written agreement with their employee (or reached written collective agreement with a trade union where the relevant terms are determined by collective agreement) that they have been instructed to and agree to stop working for a minimum of 7 consecutive calendar days. The agreement must be available for view by HMRC on request.

Employers must maintain records relating to the terms of these arrangements for each employee. They must:

- notify the employee of the agreement in writing

- make sure that the agreement is consistent with employment, equality and discrimination laws

- keep a written record of the agreement for 5 years

- this agreement must be made available to HMRC on request

- The employee must agree to the new arrangement.

BUSINESS GRANTS

Additional funding will be provided to allow Local Authorities (LAs) to support businesses in high alert level areas which are not legally closed, but which are severely impacted by the restrictions on socialising.

The funding LAs will receive will be based on the number of hospitality, hotel, B&B, and leisure businesses in their area.

LAs will receive a funding amount that will be the equivalent of:

- For properties with a rateable value of £15,000 or under, grants of £934 per month.

- For properties with a rateable value of between £15,000-£51,000, grants of £1,400 per month.

- For properties with a rateable value of £51,000, grants of £2,100 per month.

- Local Authorities will also receive a 5 per cent top up amount to these implied grant amounts to cover other businesses that might be affected by the local restrictions, but which do not neatly fit into these categories.

It is not yet clear how businesses can apply.

It will be up to Local Authorities to determine which businesses are eligible for grant funding in their local areas, and what precise funding to allocate to each business.

Meanwhile, businesses in ‘very high’ alert level areas will qualify for greater support whether closed (up to £3,000/month) or open.

SUPPORT FOR THE SELF-EMPLOYED HAS BEEN EXTENDED

The Government has announced more support will be available for the self-employed in the form of two grants, each available for three-month periods covering November 2020 to January 2021 and February 2021 to April 2021.

To be eligible for the Grant Extension self-employed individuals, including members of partnerships, must:

- have been previously eligible for the Self-Employment Income Support Scheme first and second grant (although they do not have to have claimed the previous grants)

- declare that they intend to continue to trade and either:

- are currently actively trading but are impacted by reduced demand due to coronavirus

- were previously trading but are temporarily unable to do so due to coronavirus

The first grant will cover a three-month period from 1 November 2020 until 31 January 2021. The Government will provide a taxable grant covering 40% of average monthly trading profits, paid out in a single instalment covering 3 months’ worth of profits, and capped at £3,750 in total.

The second grant will cover a three-month period from 1 February 2021 until 30 April 2021. The Government will review the level of the second grant and set this in due course.

The grants are taxable income and also subject to National Insurance contributions.

HMRC will provide full details about claiming and applications in due course and we will update you when the guidance is available.